America consumes a lot of shoes. The U.S. is the largest footwear market in the world, with over $85.8 billion in revenue in 2022. And increasingly, those shoes are coming from overseas.

So, what’s the current state of the American footwear manufacturing industry? Some of the data may surprise you.

In this exclusive report, we cover domestic shoe manufacturing trends, industry employment trends over the last 20+ years, real American consumer opinions on buying shoes, and hear straight from American footwear manufacturers about their perspective on the industry, their biggest obstacles, and the future of shoe manufacturing in the United States.

In a Nutshell

- 99% of all shoes sold in the United States are imported.

- 2.7 billion pairs of shoes were imported to the US in 2022 – an all-time record.

- 25 million pairs of shoes were manufactured in the US in 2022 – the US imports 108x more shoes than it produces.

- China is the top footwear importer to the US, exporting 1.6 billion pairs of shoes to the US in 2022. Vietnam, Indonesia, Cambodia, and India comprise the rest of the top five US importers – all unchanged from 2021.

- Over 81% of Americans want to buy shoes made in the USA vs. imported ones.

- Over 58% of Americans cite high prices and difficulty finding footwear made in the USA as their primary obstacles to buying.

Our Methodology

We gathered data from several sources to compile this exclusive report. Those sources are:

- Exclusive interviews with American shoe manufacturers. We personally interviewed owners and employees at several domestic shoe companies who offered their insights on the state of the industry.

- Survey of the general American populous. We surveyed over 500 everyday Americans to get their thoughts on buying shoes made in the USA.

- The Footwear Distributors and Retailers of America. The FDRA is a trade association that represents over 95% of the global footwear industry. They have their pulse on footwear manufacturing everywhere and publish an annual report on global shoe sourcing.

- The United States Bureau of Labor Statistics. Each quarter, this department publishes its census of employment and wages by industry and geography. Footwear manufacturing (NAICS 3162) is one of those industry categorizations.

Our findings, analysis, and aggregation of the data are below.

The US Is Primarily a Shoe Importer

The US imported a record 2.7 billion pairs of shoes in 2022, which represents over 99% of all shoes sold in the US.

The primary importers are:

- China: 1.6 billion pairs

- Vietnam: 646 million pairs

- Indonesia: 194 million pairs

- Cambodia: 80 million pairs

- India: 42 million pairs

- Mexico: 28 million pairs

- Italy: 27 million pairs

- Brazil: 19 million pairs

- Bangladesh: 19 million pairs

- Germany: 16 million pairs

The top five importers remained unchanged from 2022 to 2023, but Mexico has been trending upwards. Mexican shoe imports to the US hit a 19-year high in 2022. Most importers, including countries like Vietnam, Indonesia, Cambodia, and India, hit record highs for total shoe imports to the US in 2022.

The US would fall in 8th on that list. Let’s dive into US shoe production now.

How Many Shoes Are Made in America?

According to the latest data from the FDRA, the US produced 25 million pairs of shoes in 2022. That is less than 1% of the shoes imported, and that share has steadily declined over the past 40 years.

The Number of US Footwear Manufacturers Hasn’t Improved Recently

That annual US production total has been pretty flat in recent years, primarily because there hasn’t been a meaningful change in consumer interest (more on that below) and the number of US shoe manufacturers hasn’t changed.

The US is home to 863 footwear manufacturers, according to the latest 2023 data from IBISWorld. That number has declined by 0.5% per year (on average) since 2018.

Here are the states with the most footwear manufacturers:

- California: 167 businesses

- Texas: 107 businesses

- New York: 68 businesses

American shoe manufacturing “has to get on its toes” to bring the once vibrant industry back to the US, says Nathalie Bouchard, Co-Founder of SOM Footwear, a barefoot-inspired shoe manufacturer in Montrose, Colorado. “Many countries, not just the U.S., have pushed their skills overseas, and reversing the machine is possible but challenging, as we have experienced over the past ten years.”

“American shoe manufacturing has great potential as more people, especially those 40 years old and under, seek locally-made products. They are more environmentally conscious and like to shop small. We can see a change if people rally together and act in mass.”

As you’ll see from our American consumer survey results later, we agree about that momentum in consumer sentiment to buy American.

Availability of Certain Raw Materials Is a Big Challenge

In our interviews with several US shoe manufacturers, almost all of them cited raw material availability as one of their biggest challenges for producing 100% made in the USA shoes and why there aren’t more shoe manufacturers in the US.

“Some are available at a fair price, and others are not available or too expensive,” says Bouchard at SOM Footwear. “Sole making is a gigantic investment, and the equipment offered is for large-scale manufacturing, which does not make sense for a small manufacturer.” She also cited the gluing process and sewing automation as other production challenges.

Midsole leather is another raw material that is tough to source in the US, according to several boot manufacturers we spoke to.

It’s clear that one of the major contributing factors to the stagnation of US footwear manufacturers comes from the source – shoe components need to be more available domestically, and at reasonable prices.

Some of the raw materials aren’t naturally produced in the US, though, like natural rubber. The US doesn’t have trees that produce natural rubber (latex), but we do have plenty of options for producing synthetic rubber that is primarily derived from petroleum.

Regulation Squeezes US Footwear Manufacturers

We also talked with Josh Stiles, founder and owner of Shamma Sandals, who said part of the issue facing American footwear manufacturers is prohibitive regulation in the US. Shamma Sandals is based in California (Santa Cruz), one of the most cost-prohibitive states for American manufacturing businesses due to environmental and labor regulations.

“The bigger you get, the more expensive it becomes to operate in the US, especially in states like California,” says Stiles.

Stiles cites a vicious cycle of large US corporations moving production overseas due to costs and regulations in the US, resulting in fewer incentives for domestic availability of raw materials, and furthering the manufacturing gap between home and abroad.

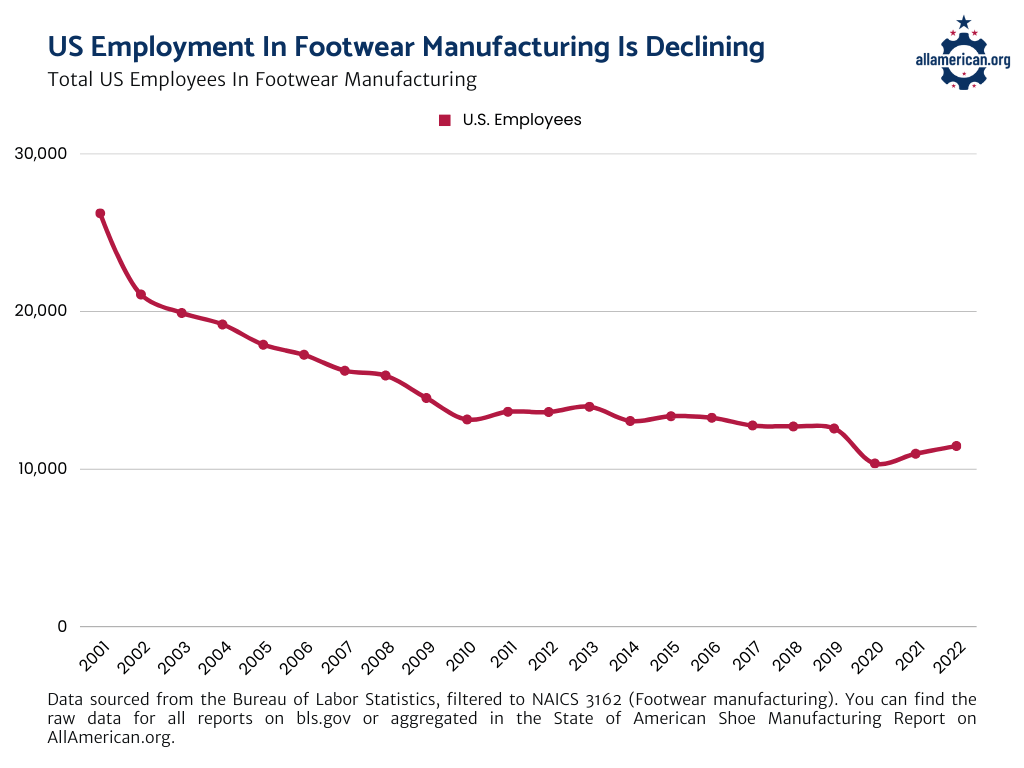

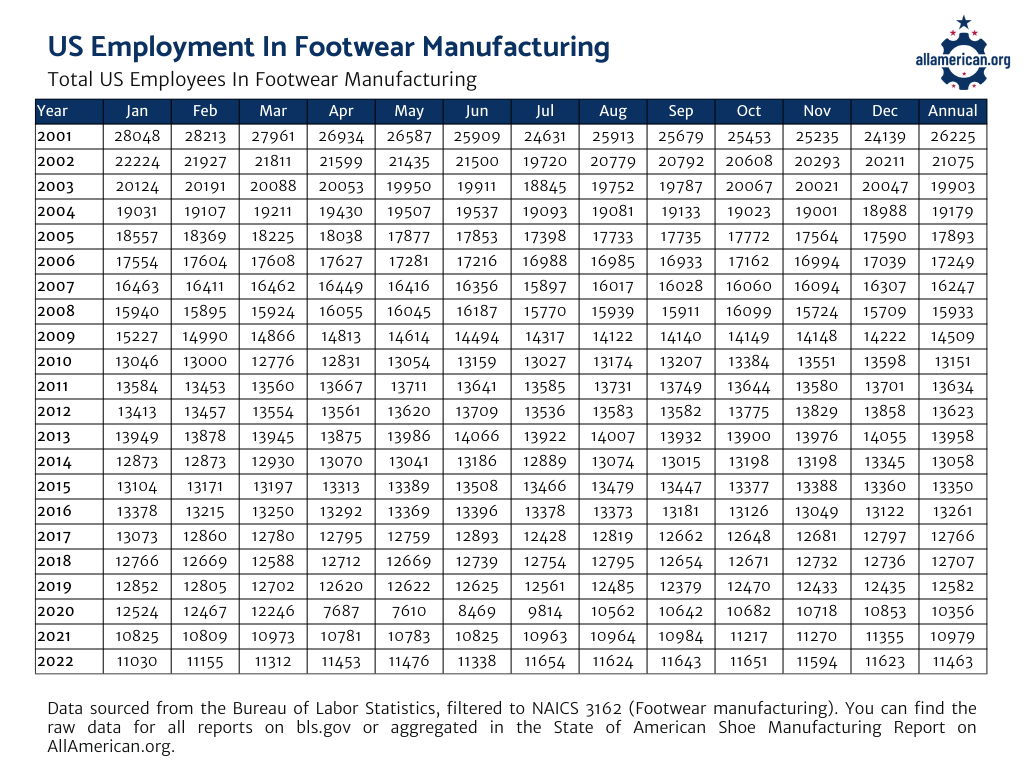

US Employment In Footwear Manufacturing Is Declining

The number of American employees in footwear manufacturing has declined by over 56% from 2001 to 2022. Looking back to 1990, that percentage decline is over 80%.

We’ve seen a slight uptick in the last two years, though, improving 9.6% from 2020 to 2022.

The most precipitous decline in the graph below occurred in the early 2000s when several large shoe manufacturers made decisions to shut down large US factories and outsource shoemaking with cheap materials and labor costs overseas.

But as mentioned above, the big decline really started in the 1980s when large manufacturers went fully international. They moved almost all their manufacturing to Taiwan and South Korea in the 80s and opened their first Chinese factory in 1981.

The labor cost difference between the US and countries like China is stark.

Let’s say a US factory pays a worker $14 per hour. Fully burdened with benefits, the total cost for the company comes out to roughly $18 per hour on average.

If you outsource to China, you’ll pay roughly $3 per hour.

Notice how I didn’t finish the above sentence with “for the same work,” as many corporate leaders might say. Because it’s not the same work – in the US, you’re getting a more skilled worker in better working conditions that’s going to have a greater net positive for our economy shoe-for-shoe.

Some American manufacturers believe the skilled workforce in the US is declining, though. “The skill level is at an all-time low,” says Vince Romano, CEO of Truman Boot Company in Eugene, Oregon.

“The biggest issue is the retirement of the baby boomers…this will continue to create many issues as the older skilled workers retire and the young workers demand more for much much less.”

Several studies support these claims, too. Older skilled workers are retiring and not enough young people are going into industrious trades.

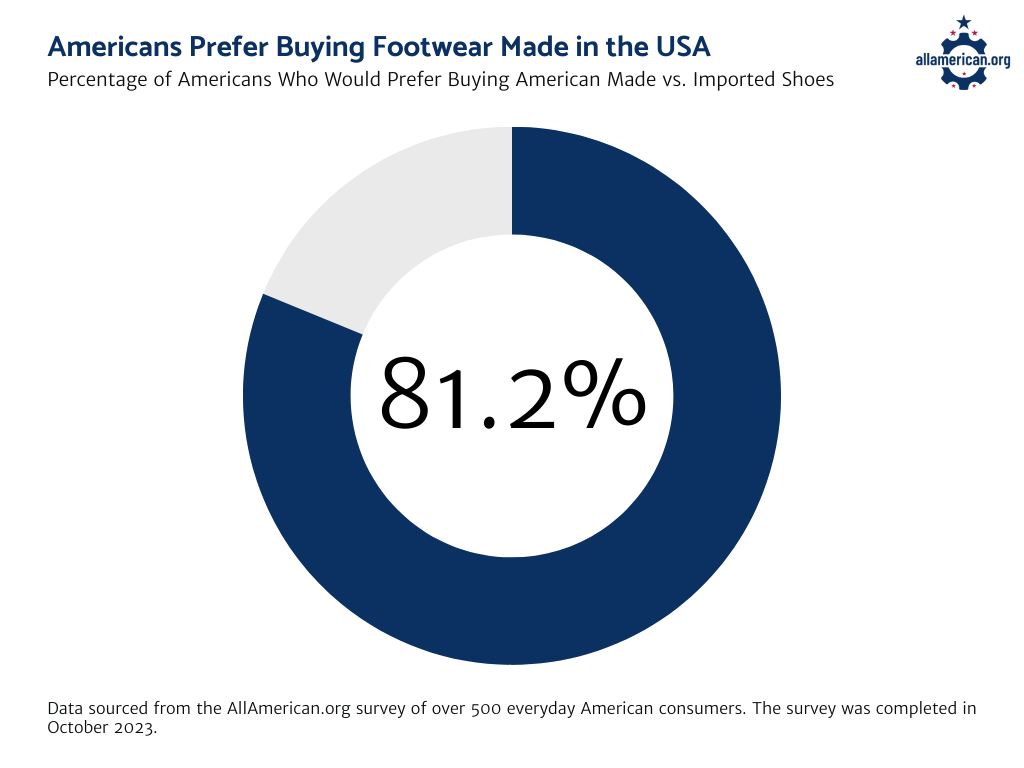

American Sentiment Is Trending Up For Buying American Made Shoes

We surveyed the general American public to get their thoughts on searching for and buying shoes made in the USA – the results were pretty eye-opening.

If given the choice, 81.2% of Americans would prefer to buy American made shoes vs. imported shoes.

US shoe manufacturers are seeing an upward trend in American made shopping, too. Bouchard and Stiles at SOM Footwear and Shamma Sandals both say their customers are loyal, and they are seeing an uptick in younger buyers.

“I believe it is trending positively,” adds Romano from Truman Boot Company. “Pride in American manufacturing and being an American is something that I think is still alive. It is this aggressive American spirit that is so intoxicating and it feels f*****g great and people want to be a part of it.”

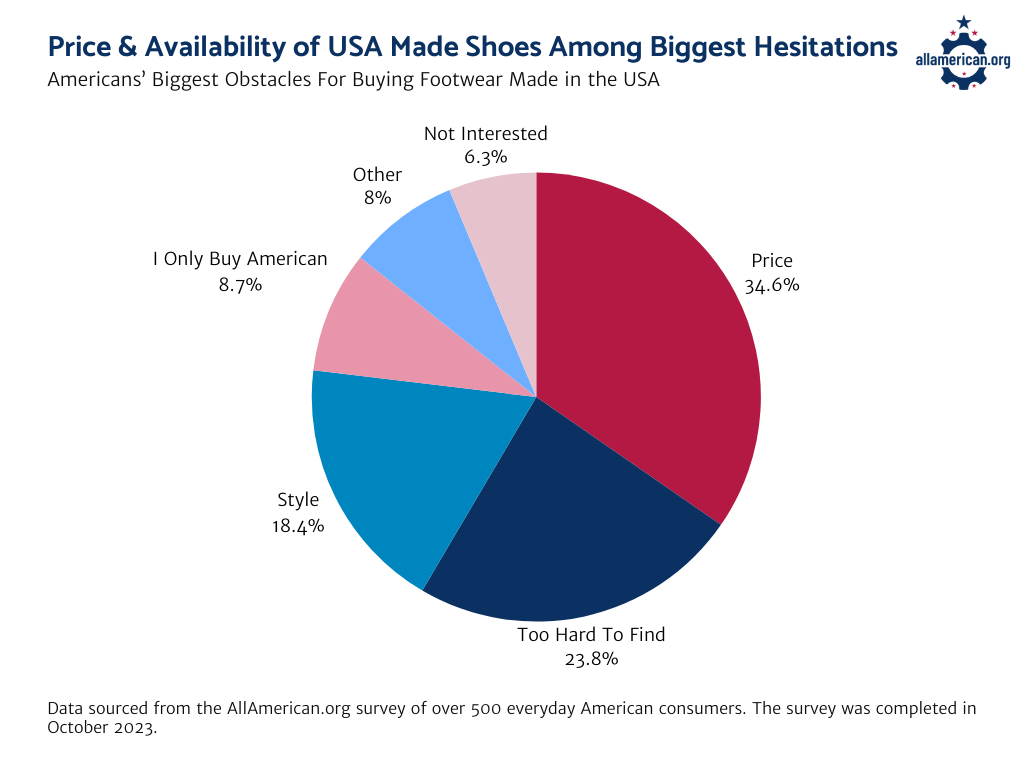

That spirit is certainly alive across the country. However, American consumers face a lot of challenges purchasing footwear made in the USA.

Only 52% of the everyday Americans we surveyed have actively searched for American made shoes, and fewer have bought them.

They cited several reasons for this, here are the most popular:

- 34.6% said prices are too high

- 23.8% said American made shoes were too hard to find

- 18.4% said they couldn’t find shoe styles they liked when looking at American made options

Foundational obstacles like material availability that SOM Footwear, Shamma Sandals, Truman Boot Company, and so many other American footwear manufacturers face drive these consumer frustrations and cause potential new industry entrants to hesitate to open more domestic shoe operations.

Getting Our Industriousness Back

“We cannot simply be a country that markets and consumes,” says Stiles.

With the move to overseas production, “We lose the equipment and dollars, but more importantly, we are losing technical knowledge and human dignity,” he says.

“A buddy of mine once said that ‘people are industrious’ – it stuck with me because it was a great little insight into the nature of people. We get our meaning and purpose from working and providing for our families, from being a productive part of society. When we remove that through political and corporate greed and corruption, it diminishes our people.”

We couldn’t agree more.

Paving The Path Forward

American consumer interest is there, and manufacturers are doing their best, we just need to connect the dots and keep building momentum.

Small manufacturers are “giving their guts to bring the industry back to the USA,” as Nathalie from SOM Footwear so eloquently puts it.

American consumer sentiment seems to be trending in the right direction; we need to continue to work hard to make sure that raw material availability and US footwear manufacturing momentum follow the same path upward.

Appendix

US Employment In Footwear Manufacturing By Month and Year

Citations:

- https://www.ibisworld.com/industry-statistics/number-of-businesses/shoe-footwear-manufacturing-united-states/

- https://fdra.org/key-issues-and-advocacy/sourcing-compliance/

- https://www.bls.gov/cew/data.htm